Locally Compliant

Invoicing

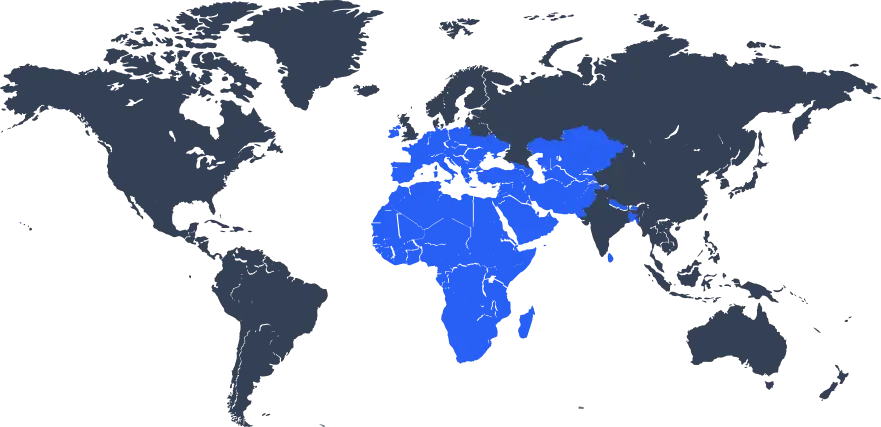

Generate tax compliant invoices and credit-notes that include all required information globally.

Trusted by the world’s leading digital companies

Why is invoicing so crucial?

Every country has specific invoicing rules. Not meeting them leads to fines, customer complaints and business risk.

Avoid penalties, unnecessary compliance costs and audit risk.

Remove the need to build and maintain your own local tax templates and technology.

Make it easy for your business customers to access accurate tax invoices and reclaim indirect taxes on their purchase.

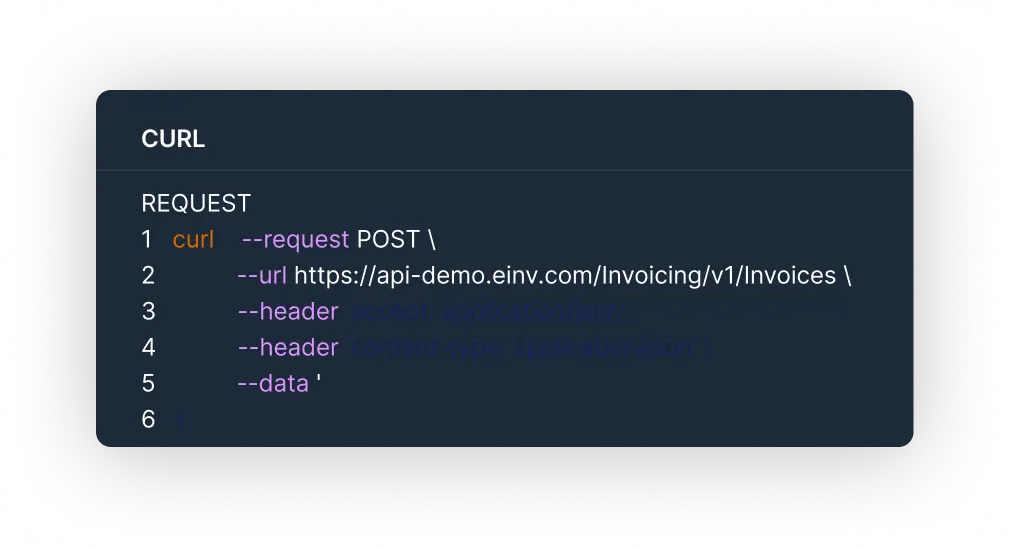

E-Invoice solution allows you to automatically generate tax compliant invoices across all your markets as well as credit notes, third-party billing and self-billing invoices.

Advanced invoicing with

global coverage

Automatically create invoices, receipts, and more based on the rules of hundreds of local tax laws.

State-of-the-art pre-validation

Advanced AI powered analytics

E-archiving and data storage

E-Invoice solution supports tax compliance at the transaction level and simplifies your global tax landscape

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Confirm your customer’s tax status

To calculate tax on cross-border sales, you must know if your buyer is a business or a consumer - and that they've got a valid/active tax ID.

Know your vendor's tax status on purchases

To recover taxes charged to you on purchases, you must confirm that your supplier is a tax-registered business with a valid/active tax ID.

Ensure your Data Sharing report contains valid tax IDs

Digital platforms and marketplaces must confirm tax ID numbers before fulfilling their reporting obligations (e.g. DAC7).

Flexibility to

fit your business

Get out-of-the-box self-billing, third party billing, and summary invoices.

Get out-of-the-box self-billing, third party billing, and summary invoices.

Get out-of-the-box self-billing, third party billing, and summary invoices.

Get out-of-the-box self-billing, third party billing, and summary invoices.

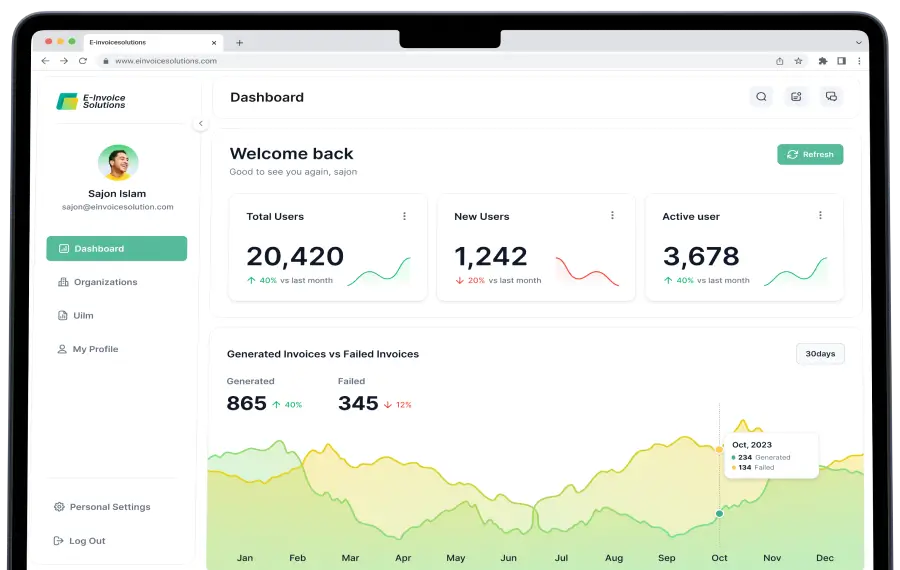

What is the Hash E-invoicing platform?

Hash e-invoicing platform is a fully automated solution which can be connected with your company ERP or billing system to generate compliant e-invoices in KSA. Hash E-invoicing platform is being designed to work with any types of ERP or billing system and with seamless integration.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

Our e-invoicing platform has a centralized user console that enables our users to operate the full functionality of the tool in a streamlined and user-centric window. Centralized access control enables the user to access all applications, websites and other computing systems from a single profile, with the same credentials from any location. All information assets in control of the user are subject to unified identity management.

E-invoicing was built for complex, online business models.

Some of the largest online marketplaces use E-Invoice Solutions to power their invoicing needs. Whether it is for their own intermediary services or to support their marketplace sellers with compliant invoicing.

Some of the largest online marketplaces use E-Invoice Solutions to power their invoicing needs. Whether it is for their own intermediary services or to support their marketplace sellers with compliant invoicing.

Some of the largest online marketplaces use E-Invoice Solutions to power their invoicing needs. Whether it is for their own intermediary services or to support their marketplace sellers with compliant invoicing.

Frequently Asked Questions

What are E-Invoicing enforcement dates in KSA?

E-Invoicing will be implemented in two phases:

– Phase One, known as the Generation phase and enforceable as of December 4, 2021.

– Phase Two, known as the Integration phase and enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in advance.

How can I implement E-Invoicing in KSA?

E-Invoicing will be implemented in two phases:

– Phase One, known as the Generation phase and enforceable as of December 4, 2021.

– Phase Two, known as the Integration phase and enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in advance.

Is E-Invoicing mandatory for me?

E-Invoicing will be implemented in two phases:

– Phase One, known as the Generation phase and enforceable as of December 4, 2021.

– Phase Two, known as the Integration phase and enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in advance.

When to issue a Tax invoice and Simplified Tax Invoice?

E-Invoicing will be implemented in two phases:

– Phase One, known as the Generation phase and enforceable as of December 4, 2021.

– Phase Two, known as the Integration phase and enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in advance.

Do I need to integrate my E-Invoicing solution from Dec 4th?

E-Invoicing will be implemented in two phases:

– Phase One, known as the Generation phase and enforceable as of December 4, 2021.

– Phase Two, known as the Integration phase and enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in advance.